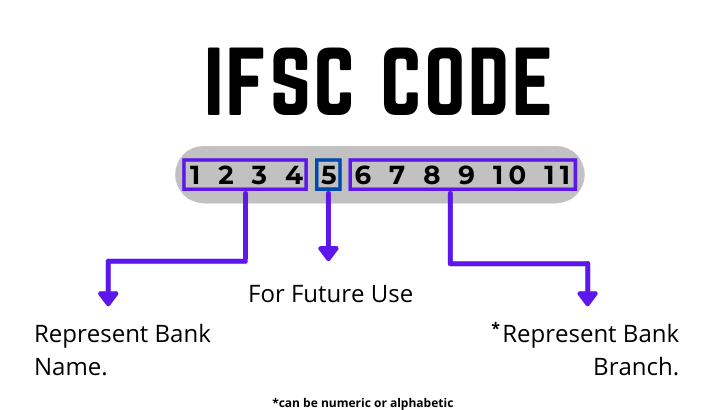

IFSC is basically a code developed by the RBI for the public which stands for Indian Financial System Code(IFSC) which consists of 11 digits alphanumeric code, absolutely unique.

IFSC code is used mainly in NEFT, IMPS & RTGS which are used for transferring funds to other banks.

There are many ways to find IFSC Code easily anywhere and its just the situation where you find any among the ways the most useful to search for. Lets dive deeper.

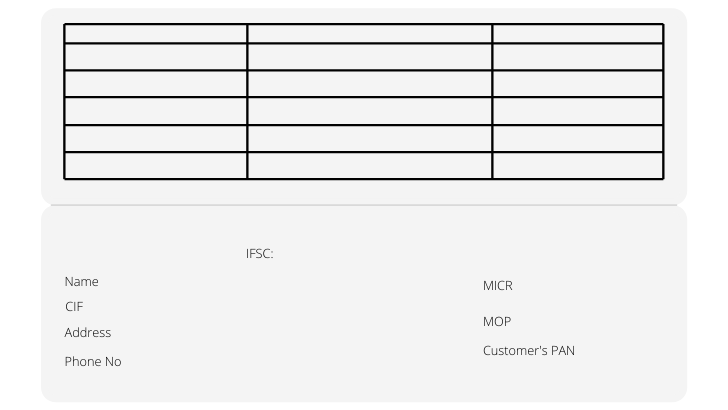

Get IFSC Code From the Passbook

Passbook is the thing that's available to all of us and by the way while creating a bank account it is given by the bank without any delay.

Now let's learn how to get that.

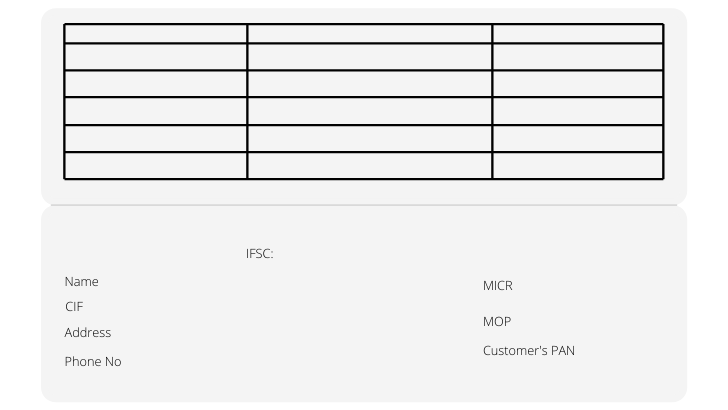

After Opening the Passbook generally you can find it on the first page to the top side. Just like the below picture shows. Otherwise you can also find it on the right side.

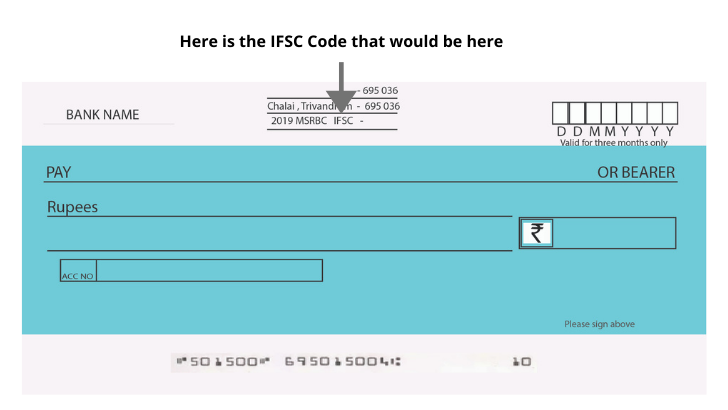

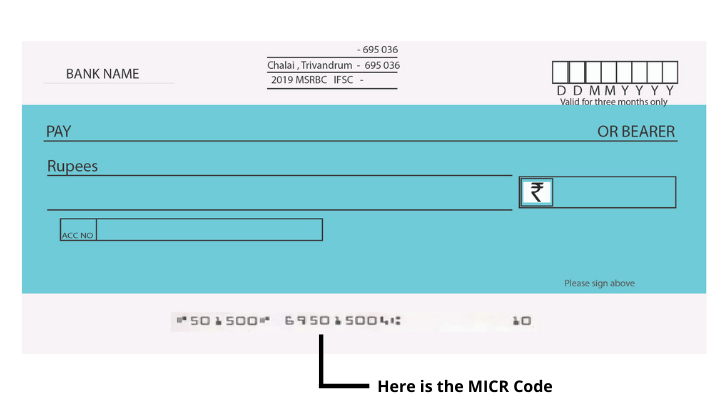

Get IFSC Code From the Cheque

If you've the cheque book, then also you can get the Code top-left side of the cheque. On every leaf you can find that just like the below illustration shows. It's that easy to find out the Code.

Get IFSC Code From the Banksforyou Tools

The best method of all and not because of using this only but you can chose any way to get but why is this so easy and beneficial to use our tool.

The main benefits that it bears are-

» It can be used on any device anywhere without even installing any application.

» It is the easiest of all, just select bank name, state, district and the branch only.

» We have over 175,000+ records of IFSC code that means you can get any bank's code even if its a small bank.

Here we can take such example that's exactly valid in real life, so get started.

Now let's take and example of a dummy bank as ABC and another bank as XYZ, now if the customer of ABC decides to transfer 10,000 Rs as example to XYZ, he would need the Name of the Account holder, account number along with a section where it's asking for IFSC Code to be entered.

Here you need to enter the 11 digit IFSC code of the ex: XYZP0896745 in this case. Otherwise some banks provide the facility to enter the location directly. Now XYZ will definitely receive the money from ACB Bank's customer if the account number entered correctly.

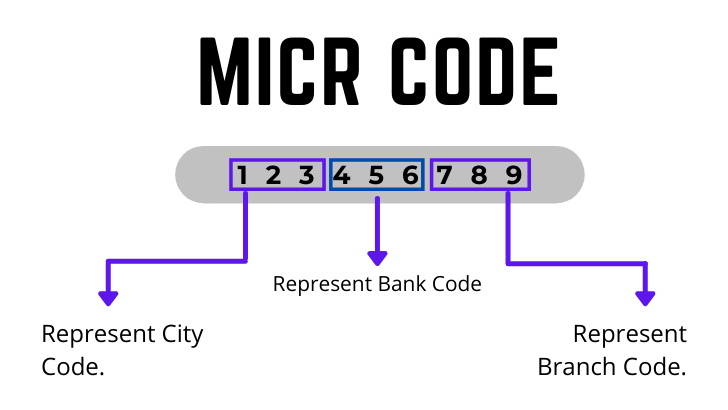

MICR stands for Magnetic Ink Character Recognition. MICR's Code consists of 9 digits, also MICR is used for identifying cheques which is best for faster processing.

Also to note MICR is not same for every customer and it applies for branches too. The MICR Code is used because of the MICR scanners which are much more efficient than the traditional OCR scanners.

There's a saying that "History repeats itself" and now we are again discussing the same types but the concept is different here. So let's not delay.

Get MICR Code From the Passbook

Passbook is the common thing that's available among the customers and easy to access too. Also here as you've seen that IFSC can be found here just like that MICR Code is also present here. Open the first page of the passbook, here you can easily find the MICR word on the right side of the page or on the top side, that differs from bank to bank. In the below demo illustration of a passbook you can find the MICR.

Get MICR Code From the Cheque

If you need to know MICR, that means you might have a cheque book along with you. However, that depends if you are collecting the information for other use. Now to get the MICR from the Cheque, you need to focus on the cheque leaf's bottom side where the MICR is mentioned for scanners to read.

Get MICR Code From the Banksforyou Tools

It shouldn't be repeated but the best method is this one as its online you can access it from any device from anywhere just it. Just select the required options and you're have MICR in front of you.

Some of the short checkpoints that needs to be discussed here to specify the use of MICR Code are-

☑ It is used for faster processing of cheques using scanners.

☑ MICR participates in Electronic Clearing System to uniquely identify the bank & branch.

For Example let's say you want to send some funds around 50,000 to other bank's holding customer and use cheque as an medium. Here you can check at the bottom that the MICR is present.

Nowadays cheques are dropped otherwise entered via a system which acts as a cheque that's virtual and the facility is only provided at some specific banks. Note even if it's a physical cheque it is send to core centre of the bank to process(Automated).

We do not hold any responsibility on any manipulated data displayed as it is being powered by Razorpay.